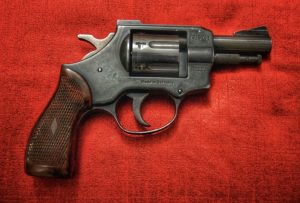

Transferring guns through estate planning requires unique planning.

People tend to have strong feelings about their firearms.

Some people appreciate them for their usefulness in hunting and protection.

Other people fear them and want them to be completely illegal.

According to a recent The National Law Review article titled “In the Crosshairs: Guns in Estate Planning,” the range of strong opinions can complicate estate planning for firearms.

Different states have different laws governing guns.

Although many people know they need to pay special attention to distributing large assets like a family home or investment accounts, personal property is easily overlooked.

Unfortunately, some personal property requires just as much special planning as the family home.

This is true of privately owned firearms.

What are important steps to distributing firearms to an heir?

First you must consider who you want to inherit a given firearm.

Why?

Certain people are not eligible to own a firearm.

The Gun Control Act of 1968 prohibited certain individuals from possessing, receiving, transporting, or shipping ammunition or firearms.

Who is included in the list?

Those who were dishonorably discharged from the military, those with mental illness, and those with domestic violence or felony convictions.

The executor of the estate must be able to confirm that the heir does not meet any of these disqualifications prior to transferring the firearm.

If the executor transfers the firearm to someone on this list, then it may be considered a criminal action.

Another thing to consider when transferring a firearm as an inheritance is geography.

Does your heir live in a different state?

If yes, then a federal firearms license holder must be utilized to make the firearm transfer.

Because different states have different laws, these laws could complicate the transfer.

An item legal in one state may be illegal in another.

Another consideration is the fluidity of laws.

Laws addressing guns and other related firearm devices change.

For example, Las Vegas outlawed bump stocks in 2017.

Without knowledge of legislation, the fiduciary may accidentally commit a felony.

To adequately address the unique issues associated with transferring ownership of a firearm, one must be informed.

One option is to utilizes a gun trust.

A gun trust can be used to protect and transfer firearms.

This is especially helpful for collectible firearms and unique firearms like registered machine guns, short barrel shotguns, short barrel rifles, and suppressors.

Collectible firearms are often expensive.

Some can be as costly as collectible cars.

As such, special care must be taken in properly transferring and preserving them.

Transferring firearms to the next generation requires the help of a professional.

Work with an experienced estate planning attorney who can help you determine if your heirs are eligible to receive your firearm and who can help you create a gun trust.

Reference: The National Law Review (May 10, 2022) “In the Crosshairs: Guns in Estate Planning”

REMEMBER: “The choice of a lawyer is an important decision and should not be based solely upon advertisements.”

This statement is required by rule of the Supreme Court of Missouri.