A comprehensive estate plan does not simply appear out of thin air.

Young people often do not consider their own mortality.

It is common to believe the next day will be much like the one before it.

Since early 2020, the uncertainty of life has become more pronounced for many Americans.

As a result, the numbers of individuals ages 18 to 34 with estate plans increased by 63 percent since 2020.

According to a recent CBS News article titled “How to create a well-rounded estate plan,” estate planning is important but is also more involved than simply writing a last will and testament.

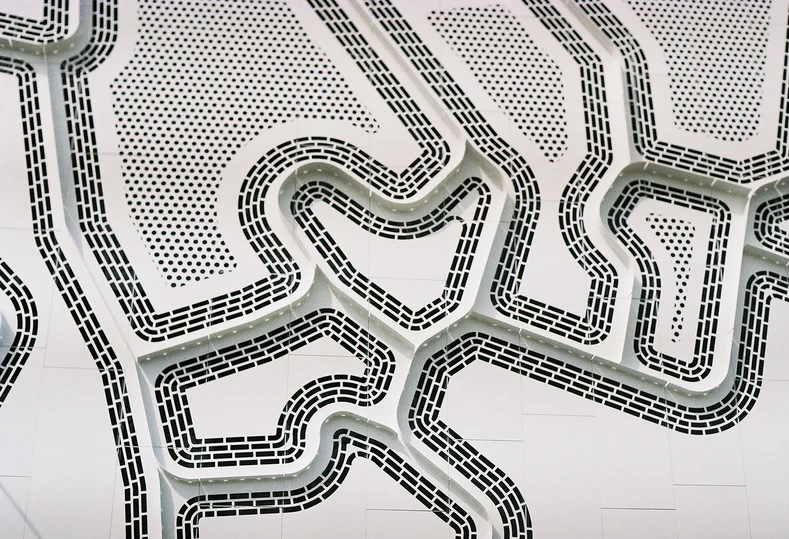

A comprehensive estate plan involves connecting dots from various aspects of your life.

Although a last will and testament is fundamental to estate planning, it is only a part of a comprehensive estate plan.

Not all documents serve the same purpose, and no one document protects you, your loved ones, and your assets entirely.

What should be included in a comprehensive estate plan?

In addition to your last will and testament where you can designate guardians for minor children, executors, and beneficiaries, you will also require powers of attorney documents.

There are basically two categories.

The first is the general durable power of attorney.

This empowers the attorney in fact (agent) to manage your business or financial decisions if you become incapacitated.

The second category is the durable power of attorney for health care matters, which is part of the advance health care directive in our law practice.

With these documents, you choose a trusted individual to make or advocate for your medical decisions if you cannot do so yourself.

With both of these, it is important to discuss the roles, responsibilities, and your wishes with the attorneys in fact/agents of your choosing.

You should also create a health care treatment directive (also included with our advance health care directive) as part of your comprehensive estate plan and outline your wishes in as much detail as your wish.

Providing written instructions and having a conversation to clarify your wishes can greatly relieve pressure on your decision-makers and ensure your wishes are carried out as desired.

Although many people select family members in these roles, not everyone has positive or trusting relationships with their families.

Whether you choose a family member or a friend to fill these important roles, you should work with an experienced estate planning attorney to ensure your comprehensive estate plan aligns with your circumstances and your goals.

Reference: CBS News (Aug. 11, 2021) “How to create a well-rounded estate plan”

REMEMBER: “The choice of a lawyer is an important decision and should not be based solely upon advertisements.”

This statement is required by rule of the Supreme Court of Missouri.