Prince left no directions for his estate when he died.

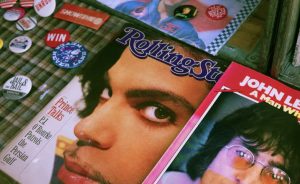

The sudden death of Prince triggered a variety of heavy emotions.

Family and fans were devastated at the news of his fentanyl overdose in 2016.

Can you believe it has been six years?

Yikes!

Some eyed his estate and were filled with greed.

Others saw only the expensive mess he left behind.

According to a recent Kiplinger article titled “Prince’s Estate Is a Royal Mess: 5 Ways You Can Do Better,” Prince left behind no last will and testament despite having a long list of living relatives.

The Prince estate is taking years to settle.

This quickly became a problem.

Comerica was designated as the institutional estate administrator.

With a long and successful music career, Prince left behind tangible assets as well as rights to his music, name, and likeness.

Naturally, the value of this estate would be great.

How great?

The IRS and Comerica disagreed.

Comerica listed the value at $82.3 million.

The IRS listed the value at $163.2 million and claimed a tax of $39 million.

After six years and legal fees in the tens of millions, the two parties have finally reached an agreement.

The estate would be valued at $156.4 million.

With this settled, the administrators can move forward with notifying heirs and distributing assets.

Although you likely do not have the wealth or fame of Prince, you can still learn some lessons from his lack of estate planning.

What are some salient takeaways?

Draft and execute a last will and testament.

Prince did not prioritize creating or updating a last will and testament.

This complicated his asset distribution significantly.

The last will and testament is submitted to the probate court and, once confirmed to be the "last" will, is used to appoint the executor to pay debts, taxes, and expenses of the estate.

Once those obligations have been satisfied, then the probate court orders the distribution of assets as you direct.

Without this document in place, the laws of the state will govern who receives your assets, as in the case of the Prince estate.

Additionally, one can designate a guardian for minor children using a last will and testament.

Without doing so, the court will choose who rears your little ones.

Did you note that you must "execute" your last will and testament, not just "draft" it?

That was not a "throw in" on my part.

One of the unfortunate facts of life I have witnessed in some three decades of estate planning?

Too many people embark on the estate planning journey with good intentions and have excellent estate planning legal documents prepared, but fail to legally execute them.

So, what is the value of such unexecuted piles of paper?

Shredder food.

Inventory your assets.

Prince had a sizable estate.

Understatement.

Perhaps he felt overwhelmed creating a list.

Perhaps he was in denial and believed he could cheat death.

It is likely you feel overwhelmed as well when you think of all you own.

Yes, it can be intimidating.

All the way from your home to the ceramic bullfrog collection proudly displayed in your curio cabinet.

To make it easier, create a spreadsheet.

Start by including the items with greater value.

You can even include a column stating who should be the recipient of tangible personal property items (think ceramic bullfrog collection) and refer to the list in your last will and testament.

However, if you elect to dispose of tangible personal property items in this fashion, make sure you carefully follow the probate laws of your state.

This another instance where the counsel of an experienced estate planning attorney can avoid family feuding!

Know the value of your unique assets.

The Prince estate faced a significant setback with the disagreement over the value of his estate.

Although the real estate component of the Prince estate was settled first, it took another year and six months to come to an agreement on the intangible asset values.

The IRS had originally levied a $6.4 million “accuracy-related penalty.”

The Minnesota Department of Revenue also had a penalty.

Both of these were eventually dropped.

Even so, the estate battle resulted in a large tax bill, let alone legal fees.

What does this mean?

The heirs of Prince will likely have to sell interests in his music catalog to pay the sum.

If Prince had inventoried and valued his assets prior to his death, he could have planned to minimize the tax bill for his heirs.

To better protect and provide for your loved ones, you should document the value of your significant assets.

If the values change in the future, you will still have a starting point for creating an estate plan to address your tax needs.

To avoid leaving a mess like Prince, schedule an appointment with an experienced estate planning attorney and follow through.

If you want to avoid probate, then ask your estate planning attorney about the benefits of creating, executing, and funding a revocable living trust.

Reference: Kiplinger (Feb. 5, 2022) “Prince’s Estate Is a Royal Mess: 5 Ways You Can Do Better”

REMEMBER: “The choice of a lawyer is an important decision and should not be based solely upon advertisements.”

This statement is required by rule of the Supreme Court of Missouri.