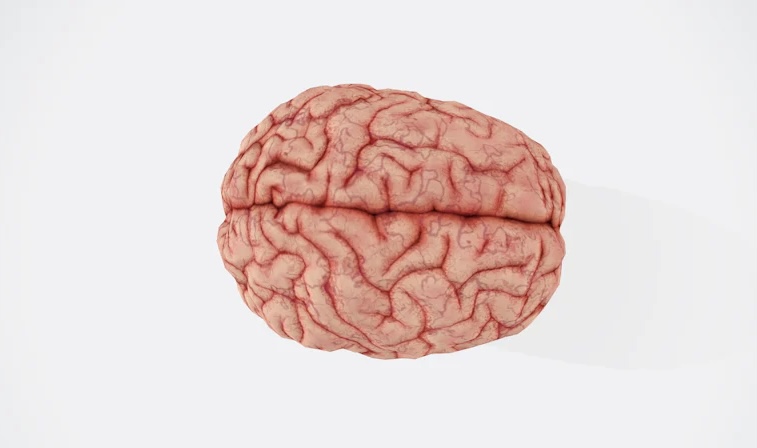

Estate planning involves addressing how to protect assets from cognitive decline.

Although many people understand estate planning involves providing direction for the distribution of assets after death, few consider how it also helps ensure there are assets to pass along after death.

Assets may dwindle as a result of creditors, divorces, and lawsuits.

While you cannot control whether someone chooses to divorce you or file a lawsuit against you, you can take some actions to prevent the need for either of these situations.

Similarly, you can reduce the likelihood of creditors by spending within your means and making timely payments.

One threat to asset protection is primarily out of our control.

What is it?

This threat is cognitive decline.

Cognitive decline cannot be prevented because it is mainly biological and not completely understood due to its complexity.

Instead, you must take action to prevent the negative consequences of this condition.

Estate planning allows you to provide protections to preserve your wealth should you become incapacitated.

Those who do not consider incapacity planning within their comprehensive estate plan can create devastating emotional and financial circumstances for their families.

According to a recent J.D. Supra article titled "Confronting Cognitive Abilities in Well-Rounded Estate Planning," cognitive decline impacts a person's ability to make rational and mentally sound choices.

The article written by Alan Feigenbaum told the story of a retired advertising executive.

This 80-year-old retiree suffered from severe delusions and was subsequently influenced by a fraudulent business associate.

This dishonest individual guided the retired executive to make poor investments.

As a result, his estate suffered significant losses.

To protect against further cognitive decline, the executive's son had to petition the court to appoint him guardian of his father's estate and financial affairs.

If proper planning had been in place, the son would have been granted authority to handle finances and minimize losses after his father was deemed incapacitated.

This would have protected against these initial losses and saved the costs associated with petitioning for guardianship.

Although you may not have a fortune at stake like this advertising executive, you should still take steps to protect your assets.

Incapacity planning helps prepare for the possibility of cognitive decline.

Plan Early and Consider Cognitive Decline in Your Estate Planning.

Do not wait until you need an estate plan to address incapacity.

It will be too late to create a plan because capacity is required to execute estate planning documents.

Rather, you will already be at the stage where you will be required to seek guardianship or conservatorship.

Yikes!

Incorporate Safeguards.

Incapacity safeguards in your comprehensive estate plan may be durable powers of attorney or trusts.

Each of these empowers individuals to manage financial affairs when they can no longer do so.

Regularly Review and Update Your Plan.

You must update your plan as your health, financial, and relational circumstances change.

For example, the agent you selected to serve as your trustee or power of attorney agent will not be able to do so if this person preceded you in death.

Seek Professional Guidance.

Estate planning must address state and federal laws and your unique circumstances and goals.

Work with an experienced estate planning attorney to ensure your plan meets your needs.

In conclusion, the aforementioned cautionary tale underscores the importance of incapacity planning to prepare for the possible eventuality of cognitive decline.

Reach out to an experienced estate planning attorney to give yourself peace of mind regarding your future mental health.

You can request a consultation with Harvest Law KC if you live in Kansas or Missouri.

Reference: JD Supra, (March 2024), Confronting Cognitive Abilities in Well-Rounded Estate Planning

REMEMBER: “The choice of a lawyer is an important decision and should not be based solely upon advertisements.”

This statement is required by rule of the Supreme Court of Missouri.