Traditional Medicare will not cover all medical expenses.

When you turn 65, you are eligible for Medicare coverage.

Traditional Medicare coverage involves Medicare Part A and Part B.

Unfortunately, you may have healthcare needs not covered by Traditional Medicare.

According to a recent Kiplinger article titled “7 Things Medicare Doesn’t Cover,” you will need to secure supplemental coverage to meet these needs.

What does Traditional Medicare not cover?

Certain healthcare expenses, like eyeglasses, are not covered by Traditional Medicare.

Prescription Drugs.

Do you require prescription medications?

If yes, you will not want to pay for these out-of-pocket.

You should look into a Medicare Part D or Medicare Advantage plan to cover this cost.

Long-Term Care.

At some point, most seniors will require long-term care.

This could look like assisted living.

It could also involve a stay in a nursing home.

How can you cover these expenses?

Purchasing long-term care insurance would be wise, especially if you want to have care provided in your own home.

Deductibles and Co-Pays.

Although Medicare Part A covers stays in a hospital and Part B covers outpatient care, you have financial responsibilities in deductibles and co-pays.

In 2020, a deductible of $1,408 needs to be met before coverage starts.

If you stay in the hospital for an extended time, you will need to pay $352 each day between days 61 and 90 in the hospital.

Past 90 days, you will need to pay $704 per day.

Throughout your lifetime, Medicare will make payments for a total of 60 days past the 90-day limit.

These are referred to as “lifetime reserve days.”

Once these have been used up, you will be responsible for all of the hospital costs.

Yikes!

Dental Care.

Teeth are important for both eating and speaking.

Unfortunately, Traditional Medicare does not cover dental care.

This means routine dental visits, fillings, teeth cleaning, dentures, or tooth extractions will be paid by you.

Although you can use a Medicare Advantage plan to cover X-rays and basic cleanings, the cap on services is generally $1,500.

For this reason, you may choose to get a separate dental insurance policy.

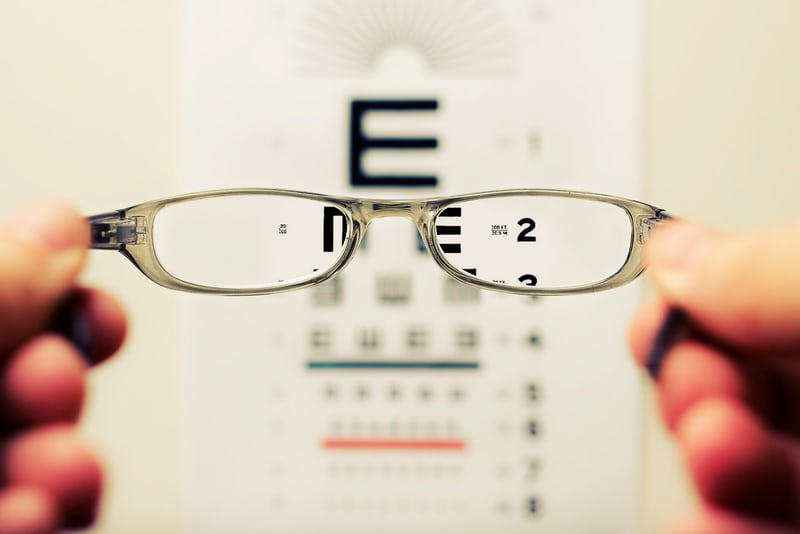

Routine Vision Care.

Eyesight tends to diminish as you age.

This is a fact of life.

Traditional Medicare will often exclude glasses and eye exams.

If you have diabetes or cataract surgery, they may cover an annual eye exam.

For other visits, you will want to use a Medicare Advantage plan or a separate supplemental policy.

Hearing Aids.

Hearing aids are not cheap.

They can cost up to $3,250 for each ear.

Your Traditional Medicare will not cover these costs.

You may be able to find a Medicare Advantage plan to provide coverage for these or find a discount program to get the hearing aids at a lower costs.

Medical Care Overseas.

If you travel or plan to live outside of the United States, Traditional Medicare will not cover healthcare costs on foreign soil.

There is a limited exception for cruise ships within six hours of a U.S. port.

Even so, you should research a Medigap plan.

Medigap plans C through G, M, and N can cover 80 percent of emergency care costs abroad with a lifetime limit of $50,000.

Some Medicare Advantage plans also provide emergency coverage abroad.

As you enroll for medical coverage, you will want to review options beyond Traditional Medicare.

Reference: Kiplinger (Oct. 1, 2020) “7 Things Medicare Doesn’t Cover”

REMEMBER: “The choice of a lawyer is an important decision and should not be based solely upon advertisements.”

This statement is required by rule of the Supreme Court of Missouri.